Buyers and sellers are asking how the pandemic and the lockdown in Canberra is having an impact on prices after a 12-month period in which time the median value cracked the 1-million-dollar mark.

Everyone wants to know whether the current buoyant mood will continue, whether we’ll witness a crash or if values will stabilise to become a new normal.

No one has the crystal ball that can answer all these questions with certainty. Even economists from respected organisations such as the Commonwealth Bank can misread the market – they predicted a catastrophic fall in prices during the first wave of the pandemic.

The opposite occurred, of course, and buyers and sellers are now legitimately concerned about where we’re heading. Is it a good time to buy? Should I put my property up for sale?

The answer to both these queries is “yes” and “yes”.

Why? Let’s talk principles. A mountain of academic research warns against trying to “time the market”. Attempting to predict when prices start moving in either direction is fraught with risks that you cannot control.

Instead, it would be best if you focused on what you can control – what’s happening in your own life.

If you’re ready to buy a new home whether it’s an investment property or to live in, then don’t restrain that ambition because of a risk that may or may not exist. A similar scenario plays out for owners. If you want to sell and live elsewhere because you need to move for work, get a larger home or other lifestyle reasons, then make your move.

Right now, the data plays in your favour. Despite the Canberra lockdown, the market is proving resilient. We have seen evidence of this on our new listings through the lockdown period. We are getting an average of 67 unique enquiries. In one case, there were 105 enquires on a 3 bedroom property in Gowrie, scheduled to go to an online auction in the coming weeks. Since the lockdown began, we have conducted 3 online auctions with an average of 12 bidders per property and a 100% clearance rate.

Our Director of Projects and Sales, Will Honey doesn’t see the market slowing.

“We're still seeing a genuine willingness from buyers to purchase all styles of properties during the current restrictions. Everything from a 1 bedroom apartment in Phillip, a 3 bedroom home in Palmerston through to off plan units and townhouses across Gunghalin and Denman Prospect. Some small but welcomed eases within our industry have recently been announced which means we can continue to bring new properties to the market to help ease the undersupply”

This financial year, residential property has risen 13.5% across Australia – the steepest value acceleration since 2004 – with houses (15.6%) out-performing units (6.8%).

Here are a few data points released in mid-July from the leading industry researcher CoreLogic. You’ll see a correlation between price rises and the well-known principles of supply and demand, and time-on-market.

Except for Melbourne (+8.7%), every mainland capital city has enjoyed double-digit growth. Sydney (16.2%) leads Adelaide (14.4%), Brisbane (14%) and Perth (10.2%).

Again with the exception of Melbourne (+2%), every capital has fewer properties for sale than 12 months ago. This time Hobart (-41.2) leads Brisbane (-26.6%), Adelaide (-23.4%), Sydney (-16.1%) and Perth (-13.5%).

Houses and units sell faster in Hobart (both 21 days) than anywhere else. By comparison, the speed at which Sydney houses (30 days) and units (39 days) move is on a par with Adelaide (32 and 35 days respectively). All the other capital cities are not far behind in the speed-stakes.

Here’s the takeaway from the national data: prices are firm and continue to grow. The lack of supply in the market, combined with record-low mortgage rates, continues to drive values. If you’re a buyer and want to wait till prices drop, you may be waiting a long time. Maybe forever. Make your move in your best interests, rather than trying to guess when a market trend might move in your favour.

This information is general only and does not constitute professional advice. You should always seek professional advice concerning your particular circumstances before acting.

Our structure and approach mean we can adapt quickly and effectively to any market situation. We are constantly keeping ourselves and our clients up to date with market conditions and legislation changes. In fact, we take an active role in lobbying the government to achieve desirable property outcomes for our clients and community. Our Director of Property Management is the President of the REIACT and leads these initiatives along with institute members. If you want advice on how to achieve your property goals in a changing market, get in touch.

How healthy is your investment property?

1. Take the 4-minute Property Health Check Survey

2. Get your instant property health score

3. We’ll provide investment performance action items.

Should I buy or sell first?

You might be surprised to learn that if you understand the process, one approach outweighs the other in terms of flexibility, time, and peace of mind if you meet the criteria.

Find out more about the process >

After more information on any of the topics?

Get in touch with us. We’ll get one of our team to contact you and answer any questions on the key info from the event.

Contact Us >

Does your property manager cover your costs when you are out of pocket? We do!

We’re not like any other property management business in Canberra. Our 4 guarantees cover you (and your costs) when it matters most.

Want to know more about our guarantees and learn what else we do to maximise your returns? Book a Southside or Northside consultation depending on where you want us to meet you.

We guarantee you won’t regret it.

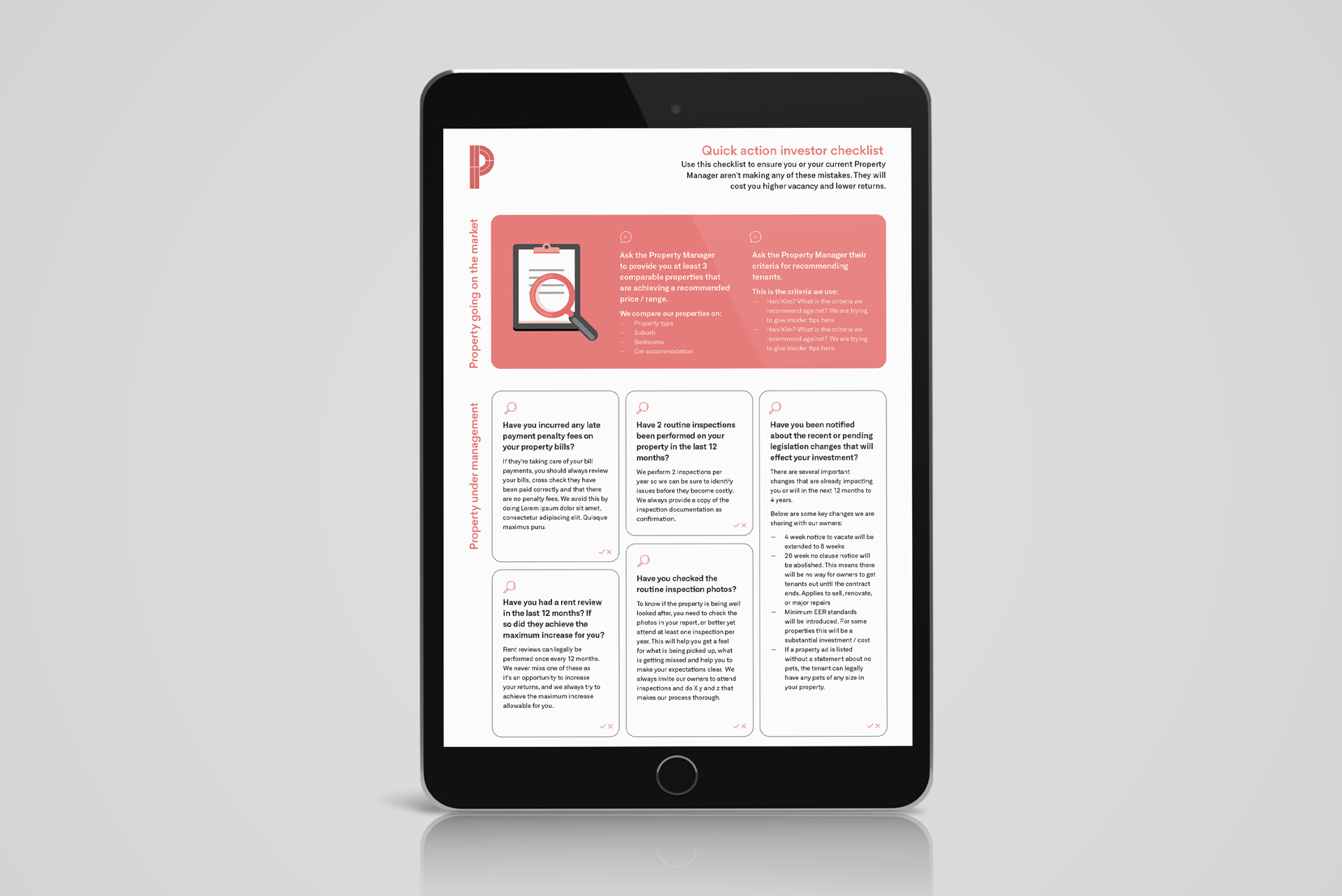

Quick Action Investor Checklist.

Is your investment property getting the care and attention it deserves? If not, we're here to help. Download our quick action investor checklist today to see if you are getting the most out of your investment property.

Download the checklist >