The rental crisis sparked by thousands of overseas students and workers returning home because of the pandemic has been turned on its head, creating fresh opportunities for experienced and first-time investors.

Demand now far outstrips supply, according to the latest figures revealed by REA Group's PropTrack rental report.

We're seeing a 37% rise in demand for rental properties against a 24% drop in availability compared with last March's figures. Every capital city has a record level of rental-shortage pain.

REA pins the cause on investors who've sold rentals at record-high prices, effectively taking their properties off the rental market.

Property researcher CoreLogic says historical yield averages of 5-6% slipped to 3.5% last year, which may explain the exodus of landlords.

But rising rents change everything.

As an experienced agency, we can see that now could be a great time to get back into the market. Average rents are up 4.7% compared with a year ago, and prices are already cooling as mortgage rates increase.

A question you'll need to answer in this new situation is the anticipated yield; that is, the future annual income compared with the total cost of your investment.

Below is a basic explanation of the yield concept so you can be more informed in discussions with your financial adviser.

Gross yield

This is the income you receive before deducting your expenses. These include stamp duty, legal fees, and other expenses associated with the purchase, plus property management fees, advertising costs for tenants, strata fees and annual maintenance bills.

Follow these 3 easy steps to calculate the yield.

1. Sum up your total annual rent that the property would earn.

2. Divide your annual rent by the value of the property – the purchase price.

3. Multiply that figure by 100 to get the percentage of your gross rental yield.

For example:

$25,000 (rent earnings)

Divided by $500,000 (property value)

Multiply by 100

Equals 5%

Net yield

After subtracting all your expenses (stamp duty, legal fees, and other expenses associated with the purchase, plus property management fees, advertising costs for tenants, strata fees and annual maintenance bills) from your future income, you're left with your net yield. You'll be able to see whether you'll make a profit or a loss, which plays well if you want to negative-gear the property for other tax reasons.

Your return

The big difference compared with net yield is that your return calculation includes a prospective capital gain based on past performance.

Please consult with a professional adviser for information about tax benefits, cash-flow implications and how a purchase might align with your wealth goals. This information is general only and does not constitute professional advice. You should always seek professional advice concerning your particular circumstances before acting.

On the lookout for the best investment property? Us too! We work with hundreds of investors who turn to us for our advice and to help them find the most suitable investment property to build or add to their portfolio. Each of our investor’s needs are different from the next, and we customise investment property opportunities to meet their specific needs. If you want to grow wealth through property, whether you are just starting out or have a substantial property portfolio, we can help.

How healthy is your investment property?

1. Take the 4-minute Property Health Check Survey

2. Get your instant property health score

3. We’ll provide investment performance action items.

Should I buy or sell first?

You might be surprised to learn that if you understand the process, one approach outweighs the other in terms of flexibility, time, and peace of mind if you meet the criteria.

Find out more about the process >

After more information on any of the topics?

Get in touch with us. We’ll get one of our team to contact you and answer any questions on the key info from the event.

Contact Us >

Does your property manager cover your costs when you are out of pocket? We do!

We’re not like any other property management business in Canberra. Our 4 guarantees cover you (and your costs) when it matters most.

Want to know more about our guarantees and learn what else we do to maximise your returns? Book a Southside or Northside consultation depending on where you want us to meet you.

We guarantee you won’t regret it.

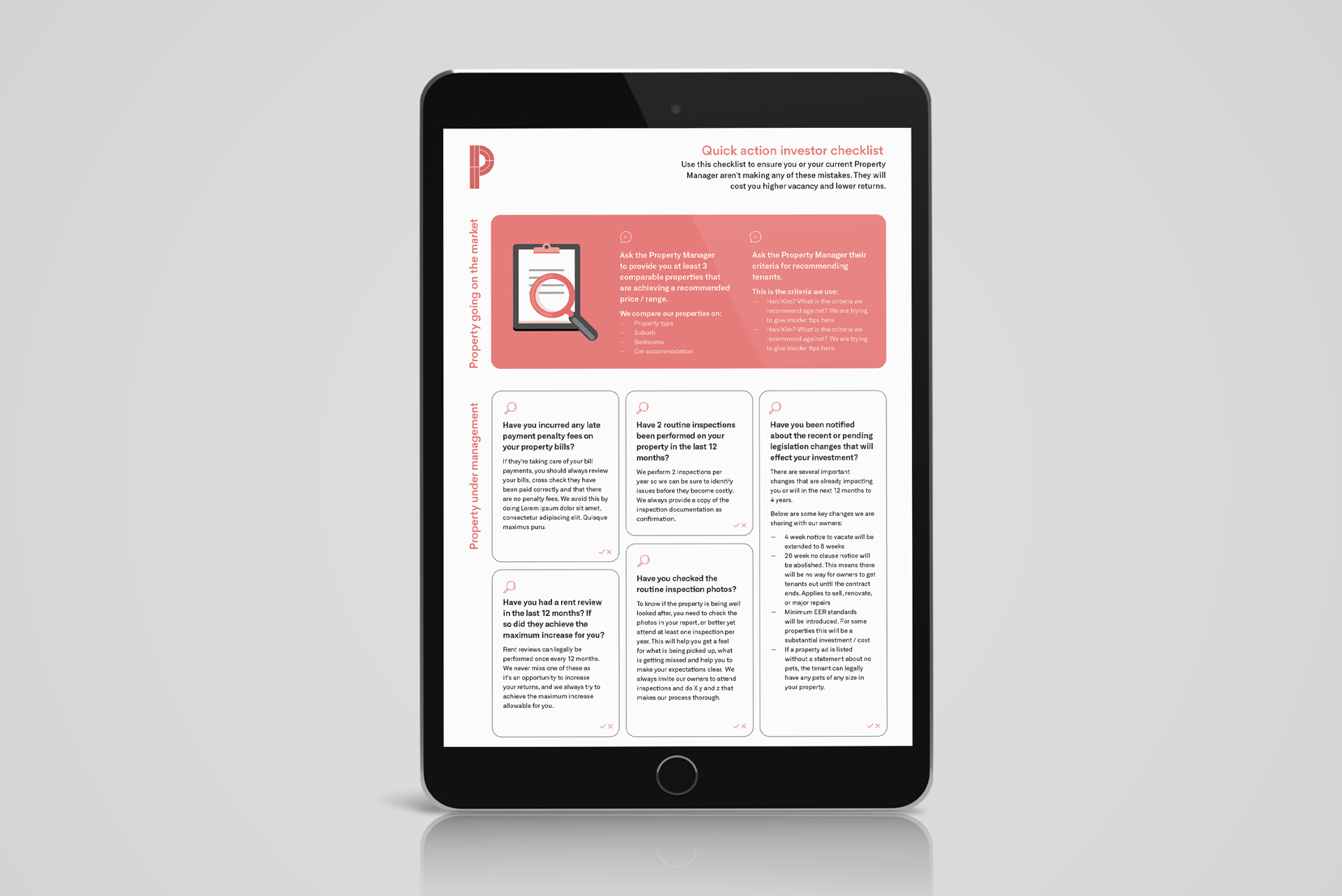

Quick Action Investor Checklist.

Is your investment property getting the care and attention it deserves? If not, we're here to help. Download our quick action investor checklist today to see if you are getting the most out of your investment property.

Download the checklist >